from:China Electricity Councildate:2014-05-12

CEC Published Power Supply and Demand Analysis and Forecast Report of Q1 2014 in China

I. Supply and demand analysis of Q1

1. Power consumption was generally stable

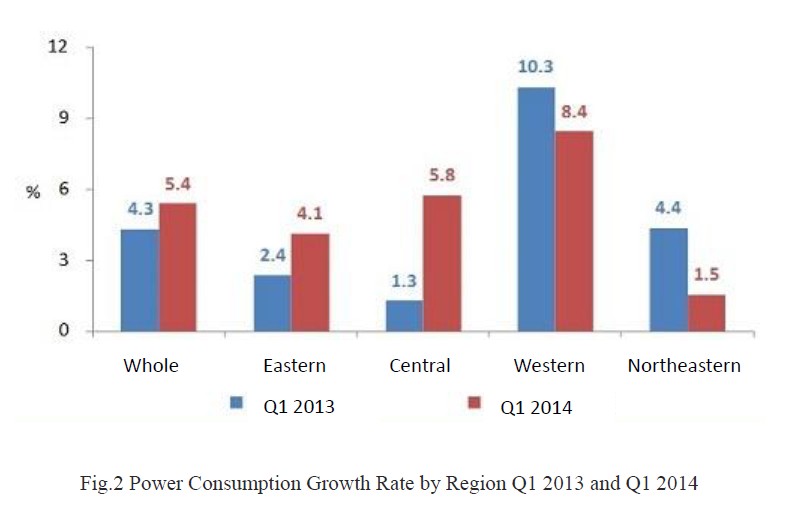

Total power consumption reached 1280TWh, a 5.4% increase from last year. The growth rate was 1.1 percentage points higher than Q1 2013, but 3.0 lower than Q4 2013. This was due to three major reasons: (1) the winter was warm so that electricity used in tertiary and residential heating was reduced; (2) some industrial customers lowered or stopped production to ease overproduction or deal with heavy smog; (3) macro economic development slowed down, for example, fixed assets investment growth rate dropped, and export decreased.

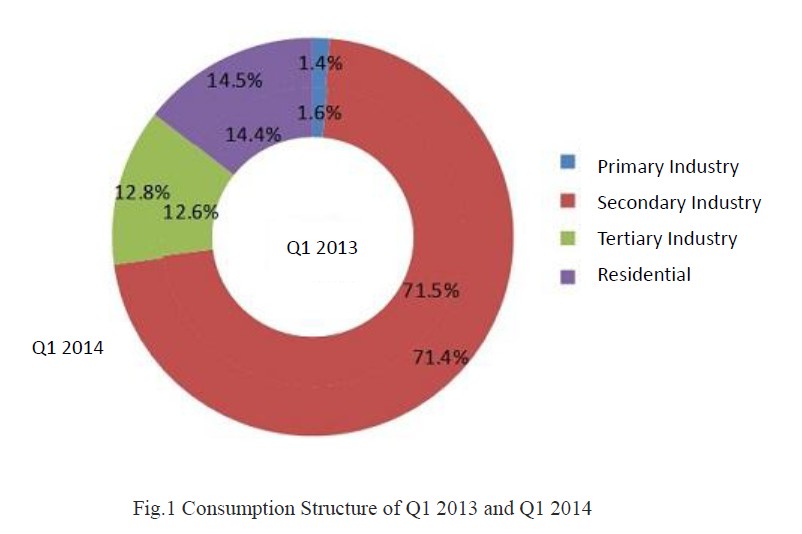

Restructuring in power consumption went further.

Growth rate of tertiary industry and residential consumption was relatively low. Power consumption in manufacturing was over 10% while the 4 most energy consumptive industries experienced lower growth rate. Western China kept the lead in power consumption growth; and Central China was bouncing back on consumption growth.

2. Investment in power generation went down sharply; utilization hours of hydro, thermal and wind power facilities decreased compared to last year

Hydropower: capacity under construction shrank to 44GW; and investment was decreased by 38.3%;

Wind power: investment went down by 18.1%; and utilization hour was decreased by 56 hours to 479 hours;

Integrated solar power: installed capacity was increased to 17.58GW, 3.4 times more than Q1 2013.

Nuclear power: investment was 11.2% lower than Q1 last year; one unit went into operation in March;

Thermal power: investment went down 13.9% and newly installed capacity went down to 5.66GW;

Inter-region transmission: kept a high speed growth rate of 15.7%;

Coal supply was generally adequate while gas supply was tight.

3. Power supply and demand was balanced overall

II. Power Supply and Demand Forecast for Q2-Q4 2014

1. Consumption will see a steady growth; growth rate is expected to reach 6.5%-7.5%, lower than last year.

2. Power supply is sufficient; proportion of non-fossil fuel capacity keeps increasing. Total installed capacity is expected to reach 1.34TWh, including 450GWh from non-fossil fuel.

3. Power supply and demand is expected to be balanced in general.

III. Suggestions

1. Enhance coordination between generation and transmission to promote the scientific development of green electricity: (1) approving and starting the work on key generation projects, especially hydropower and nuclear power; (2) increasing investment in power grids; (3) improving and implementing policies on distributed power generation development; and (4) perfecting the cost compensation mechanism for peak load and frequency adjustment.

2. Straighten electricity and heat price mechanism: (1) formulating an independent transmission and distribution price mechanism; (2) accelerating power generation price reform; and (3) repricing heat to support cogeneration plants with large deficit in certain regions.

3. Speed up alternative energy projects to increase the use of electricity in energy end-use and the proportion of coal-fired electricity generation in coal consumption: (1) formulating alternative energy project strategic plan; (2) implementing alternative energy projects in industry, transportation, construction, agriculture and residential level; (3) optimizing distribution and allocation of power source; and (4) promoting energy saving and emissions control through market mechanism and economic method.

4. Deal with smog scientifically based on objective evaluation of the influence of coal-fired power plants on smog: (1) analyzing the effect of special emissions limit; (2) guiding enterprises toward a long-term, sustainable, stable, technically viable and economical technical roadmap; and (3) postponing the deadline for environmental modification for certain regions to avoid possible undersupply.

Tel:+86-25-84152563

Fax:+86-25-52146294

Email:export@hbtianrui.com

Address:Head Office: No.8 Chuangye Avenue, Economic Development Zone, Tianmen City, Hubei Province, China (Zip Code: 431700) Nanjing Office: Building 23, Baijiahu Science and Technology Industrial Park, No.2 Qingshuiting West Road, Jiangning Economic Development Zone, Nanjing City, Jiangsu Province,China (Zip Code:211106)